Residential Energy Credit

Want to save energy and decrease your utility costs? Start by sealing your home’s envelope (the doors, windows, exterior walls and other openings) that air may leak through. Buttoning up all the major air leaks such as dryer vents, vent fans, vent stacks, attic hatches, registers and soffits can diminish a structures need for the constant pumping of hot/cold air into it. Best of all, get a Residential Energy Credit from Uncle Sam! 10% of cost up to $500!

Seal Your Home’s Envelope

Reducing your home’s exchange of heat can drastically cut into a big energy bill. Most every home can benefit from sealing all the leaks and gaps in a typical envelope. Pairing the proper amount of insulation with a reduction in your home’s air flow is a great way accrue real savings every year!

Beyond increasing the overall comfort of a house, insulation also provides:

- Noise reduction from external sources

- Less pests, pollen and dust entering the household

- Better control over the structures humidity

- Snowy climates benefit from a reduced chance of ice dams on the roof and eves

Residential Energy Credit Requirements

If you’ve added insulation this year, or are planning to, you may be eligible to receive a $500 tax credit from the federal government.

The tax credit amount is 10% of expenditures, up to $500 for the year, for all energy improvements combined.

Make sure to save all receipts and labels for submission

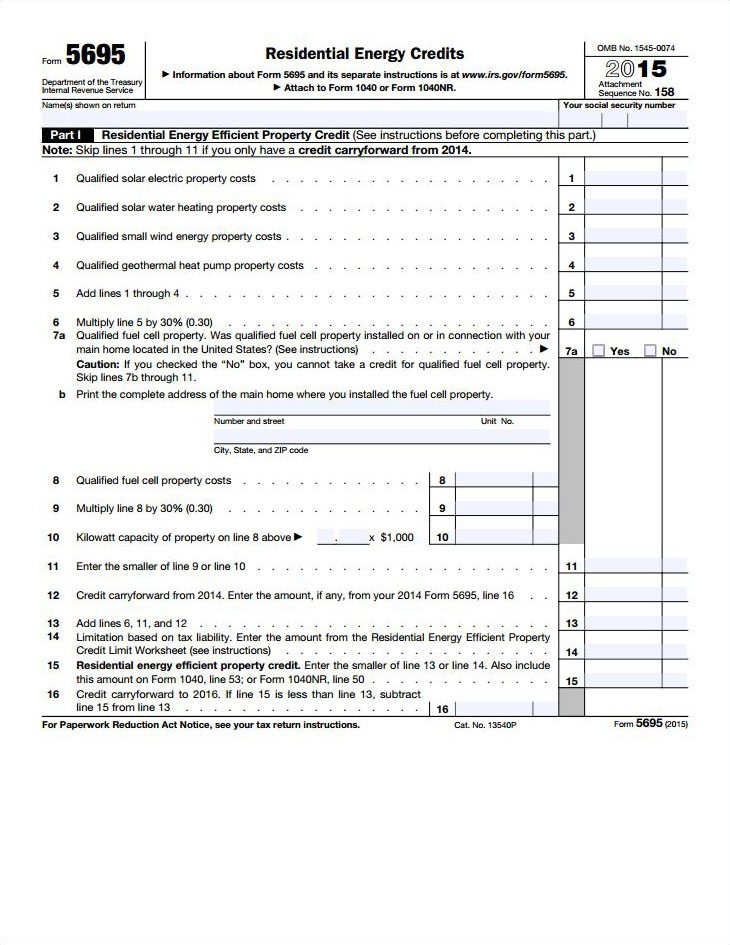

When filing your taxes, complete and include the IRS Form 5695 with your return.

For further reading on the subject, Energy Star’s Website is a great resource of information on how to get the credit and much more.